AI solutions

What we do

Services

Experts in

How we work

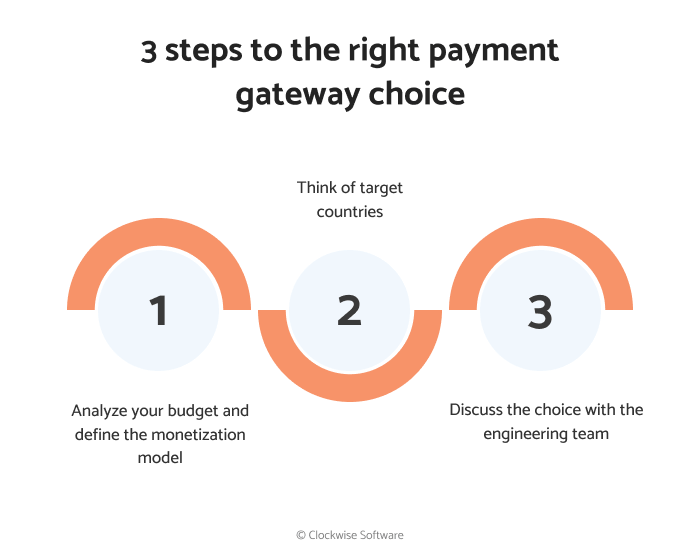

A payment gateway for a website is a tricky topic. It may either provide world-class UX and make customers spend more on your website or repel them and make never come back again. With its help, your business may either multiply the revenue or collapse at the very beginning. It’s a challenge to find the best payment gateway with a myriad of solutions in the market. That’s why, beyond just choosing a provider, many businesses also seek payment gateway integration services to ensure the solution is implemented securely, seamlessly, and in line with customer expectations. Thus, we have decided to prepare a definite guide on choosing the payment gateway for your exceptional case.

Here, you will:

Let’s start the investigation.

10% of online shoppers may abandon your website if they don’t find a preferred payment option. Thus, if you plan to build a vital, attention-winning website, you should choose your payment gateway wisely.

1. First, answer financial questions

Proper planning is everything. So take another look at your business plan canvas and pay particular attention to the factors like:

Choosing among multiple options, make sure that payment gateway price, or fee that may consist of several factors, is affordable. Before you launch an MVP and start raising funds for your startup, your budget may be limited. At the very beginning, it may be an excellent choice to use a payment gateway that offers basic functionality for an affordable price.

Another crucial question to answer is your app’s monetization model. There are multiple ways to make a profit with your app. To make the right choice, think carefully about the type of services you’d like to provide:

Depending on an industry you would like to improve with your app, and app’s specifics, some of the services may be better for you. We will cover this topic in our next chapter, so keep reading.

2. Location matters

Here, consider two critical aspects:

The “one-fits-all” solution doesn’t exist. Some services cover European Countries only, and others focus on G8 countries. If your business is local, the decision is easier. Almost every country has a local solution with the lowest rates and specific payment methods, which will help you make your business more profitable. Thus, depending on your vision, shortlist the countries you’d like your app to support at the very beginning. Compare it to the countries your preferable payment services support and choose the perfect match.

3. Discuss the choice with your engineering team

There are two types of payment gateways:

Integrated payment gateways require a technical background. To set up the solution, provide flawless service to the customers, and solve potential issues instantly, you need to have a qualified IT engineering partner by your side.

Hosted service may be a better choice if you don’t have software engineers on your team. In this case, you are only responsible for connecting the payment gateway to your website. The engineering team that represents the service deals with all the rest. However, here, lack of customization, delayed reaction to complaints, and other difficulties may occur.

Many payment gateways require strong coding skills. Thus, you need not only competent advice but also technical background. A reliable, expert development team would be your best help and support making a payment gateway choice.

Now, let’s take a look at the best options available.

A payment gateway is a digital bridge between your business and a financial institution your customer’s account belongs to. The service processes a payment in a secure, fast, and user-oriented way. The right payment gateway is the key to running a successful online business. The variety of available services makes the final decision difficult, so your choice should be carefully considered.

The early history of the company was connected with the name of Elon Musk, who was one of the founders and the CEO of the company until 2000 when he left due to disagreement with other board members. Two years later, eBay acquired the payment service. As soon as the potential of PayPal became evident, it became an independent company that now operates transactions across the globe. Nowadays, a lot of companies choose this service due to its established reputation.

If you are undecided about a hosted or integrated gateway - PayPal offers both options, depending on the plan you choose. Both PayPal Payments Advanced and Pro accounts allow payments to be processed directly on your website. PayPal Payments Standard is free and redirects users to PayPal’s page to enter their payment details.

PayPal is surprisingly friendly when it comes to integration. The company claims that even non-developers will be able to add the “Buy it now” button to their website. After pressing this button, users will be redirected to PayPal’s page to process the payment. However, the integrated checkout page will require some development work. So if you personally don’t have any coding experience, consider hiring someone to do this for you.

With 200M+ active users, PayPal is available in 202 countries worldwide and supports 25 currencies. It is highly likely that the currencies that fit your needs will be on the list. The service charges from 3.4% + $0.30 for each transaction. The Advanced and Pro accounts are also charged $5 and $30 per month (respectively) as a recurring payment.

PayPal isn’t the best choice for marketplaces since it doesn’t have a complex solution for payouts. However, Braintree, one of the payment service providers recently acquired by PayPal, does. Keep reading, we will describe Braintree’s solution in the next block.

PayPal customer service and technical support appear to be quite good. Besides the normal email and phone support, the users can also reach the company via Facebook and Twitter, although phone support doesn’t have the best feedback. The community forum, on the contrary, offers help at any time. PayPal is a reliable service, which is acknowledged by the eminent names on its list of clients.

The company’s name, Braintree, stands for stability and reliability, and this is true. Since it was founded, the service has focused on providing exceptional customer service and has attracted some pretty big clients. It acquired the mobile payment service Venmo and, in 2013, became part of PayPal.

Braintree provides client libraries for popular programming languages and mobile libraries for iOS and Android.

The company also provides a solution for platforms calling Braintree Marketplaces. This service enables automatic payouts to sub-merchants. Braintree Marketplaces is currently supported only in the USA with currencies limited to USD.

The standard pricing for service usage is 2.9% + $0.30 per transaction. An additional 1% is applied to foreign currency transactions. Large enterprises can request a custom quote.

Customer support is limited to email and phone.

In our portfolio, you can also find a project that involved integration with Braintree. This is the online form builder, EmailMeForm, which follows the subscription model. When we integrated the subscription, we considered the solutions offered by PayPal and Braintree. At that time, Braintree offered a high-end recurring billing solution, which perfectly matched the needs of the product. It made subscription payments automatic and allowed client billing data to be stored on Braintree servers. Check out our works for more information on the development process.

Stripe is PayPal’s nearest competitor. Although they have many things in common, there are still some points where Stripe is beating the industry leader.

The service integrates directly into the website, which means that users won’t be redirected to another website to enter payment data.

Most features of Stripe require the work of a professional developer. The service was, in fact, created for developers and with their needs in mind. The solution enables “robust, scalable, flexible integrations,” as Stripe promises on its website. The developers themselves compliment the well-structured API with extensive documentation. There are a bunch of libraries created for different programming languages, which is a huge advantage!

Stripe supports more than 135 currencies, which is necessary for international businesses. It allows you to charge customers in their own currency while receiving the money in your currency. This service is supported in over 120 countries, including the USA, Canada, Australia, Japan, and most European countries. However, your business should be based in one of the 39 countries listed on a company’s website.

As your sales grow, you may qualify for a lower transaction fee. Stripe doesn’t charge any monthly fees, and there is no early termination fee.

In addition to this, Stripe offers a service for platforms and marketplaces called Connect. It ensures quick integration with the platform, enabling one-to-one, one-to-many, many-to-many payments, and holding funds. The platform can collect money from customers and make payments to contractors in over 15 currencies. The fees are quite attractive as well. For each payout, the marketplace owner has to pay 0.25% from each transaction and $2 per month for each active account. Compared to regular transaction fees, Stripe Connect’s rates are quite low. The developers-first approach enables Connect to be customized according to the needs of the platform.

Stripe offers customer support via email and various social networks, but no phone support. This might be an issue for those who prefer to talk to technical support live.

Our personal experience proves that Stripe is an extremely developer-friendly service, and can be customized to meet the needs of practically any product. For example, one of our recent projects was the call tracking service Knocking. The product follows the subscription model, combined with individual purchases. Also, we needed the flexibility to offer special fares for our clients. Together with the customer, we made a strategic decision and chose Stripe as the payment gateway. It matched the project needs ideally.

Besides, Stripe appeared to be a perfect fit for several more projects we participated in. We integrated this payment gateway in Strapping - a custom order management system. With its help, the system charges a fixed fee depending on the client’s subscription plan.

Creadoor, an online marketplace that connects photo makers with businesses in need of high-quality content, uses Stripe payment gateway, too. Stripe allows holding the payment in escrow until the order is completed.

Stripe is a perfect choice for a variety of cases, apps, and solutions. Maybe, it would be an ideal choice for your startup, too?

Adyen is a payment gateway from the Netherlands, which is currently experiencing rapid growth. The service supports the majority of currencies. Besides, the Dynamic Currency Conversion at the point of sale enables buyers to choose the currency they want to pay in, as it allows them to decide which is the most profitable one.

Adyen pays a lot of attention to the payment methods used in different countries. This gateway supports over 250 payment methods worldwide. As a customer of Adyen, you will be able to offer your buyers the most convenient way to pay online, including:

The fees are quite attractive, €0.10 per transaction plus the commission depending on the payment method (up to 3.95% for transactions using American Express).

The company also offers a solution for marketplaces, splitting customer transactions and settling them to multiple bank accounts, which means faster payouts. Bank account payouts are available for the residents of most European countries, the UK, Canada, and the US. All other clients can receive their payouts as a SWIFT bank transfer

Adyen doesn’t charge a termination fee but requires two months’ written notice before an expected termination. Technical support is available via phone and email.

The next tool we highlight in our payment gateway comparison is Checkout.com.

With its data-driven approach, Checkout.com broke into the top payment gateway providers list. The company offers a unified solution to reach out to a potential customer wherever he or she is. The coverage is global: supporting more than 150 currencies in more than 50 countries worldwide, the company does its best to serve modern businesses’ needs.

The team grows rapidly: in 2018, Checkout hired 300+ specialists and opened two new offices. In 2019, it raised $230 million in funds. In spring 2020, it acquired Pin Payments, an Australian fintech startup.

We used Pin Payments as a payment system for an Australian-based online marketplace for parents and babysitters called Toddy. Check out its story!

On Checkout.com, users can access advanced data and report features. The functionality helps to keep an eye on all financial processes, reveal decline or delay reasons, speed up the approval time, etc. World-class fraud protection, along with risk prevention functionality, makes it a perfect choice for any business. Payment processing uses Machine Learning technologies, which allows faster transactions and eliminates errors.

Pricing details are available upon request only and depend entirely on your location, business size, and specifics.

This is one of the most mature, most powerful payment gateways in a global market. Acquired by Visa back in 2010, Authorize.net serves the needs of thousands of small and medium-sized businesses.

The service meets potential users’ requirements precisely. It provides high-quality functionality for fraud detection, enables the seamless check out procedure, allows creating invoices and setting up recurring payments, etc. You can choose a payment type that serves your needs best.

Authorize.net effortlessly integrates with existing businesses. API with an in-depth developer guide is available. Although the service provides the entire pieces of code and methods to add to your website, the technical background may be needed to make everything correctly.

Here, you may find the exceptional customer support services. The team of specialists ready to answer your questions is available 24/7 by chat or call.

Not so many startups succeed at providing payment gateway services. Square did.

Once upon a time, a problem emerged. James McKelvey, a talented glass blower from Missouri, couldn’t sell his hand-crafted faucets. At his studio, he could only accept cash, and when a client with a credit card came by, the sale couldn’t happen. So he shared his trouble with his friend and in a month, the Square prototype was ready.

The team built a convenient solution powered with inexpensive card readers. Transparent and reliable fees distinguished Square from similar products, made it more profitable and attractive for small and medium businesses.

Now, the company provides a wide range of services like online payment processing, hardware terminals, and POS set up, risk management solutions, etc. They offer several APIs to streamline financial operations, transfer transactions across business systems, and deal with many other processes. Using a Square Online Checkout feature, you just create a pay link, share it anywhere, and accept payments.

If you have a brick and mortar store and look for opportunities to go online, Square may be the right choice as an end-to-end payment processor.

Supporting numerous payment methods, serving the needs of entrepreneurs based worldwide, 2checkout found its place under the sun. Now, more than 17,000 companies use 2checkout system as their payment processing service provider.

Here, you may find numerous products for your online business improvement: tools for global payment, eCommerce solutions, tax calculators and reporting tools, etc. The 2checkout team continually works on customer experience improvement—optimized payment routing speed up payment rates. Still, there’s a drawback. The payment gateway may accept multiple currencies. However, you can get your payout only via wire transfer, PayPal, Payoneer on in one of the available currencies (USD, EUR, GBP).

Now, when you are acquainted with the players, here’s the payment gateway comparison:

| Payment gateway |

Supported currencies |

Supported countries |

Fee | Support | Famous users |

|

PayPal |

25 | 200+ | from 3.4%+$0.30 | Email, phone, social media | Google Play, Adidas, IKEA |

|

Braintree |

130+ | 45+ | 2.9%+$0.30 | Email, phone | Uber, Airbnb, Dropbox |

|

Stripe |

135+ | 39 | 2.9%+$0.30 | Email, social networks | Shopify, Kickstarter, Salesforce |

|

Adyen |

37 | 20+ | from 3.95%+€0.10 | FAQ, chat | Netflix, Spotify, Evernote |

|

Checkout.com |

150 | 50 | N/A | Samsung, Dior, TransferWise | |

|

Authorize.net |

10+ | 30+ | 2.9%+$0.30 | FAQ, chat, phone | YesMagazine, Magento |

|

Square |

5 | 5; cross-border payments are unsupported | 2.9% + $0.30 | Chat, FAQ | Grubhub, UberEats, Doordash |

|

2checkout |

100+ | 180 | 3.5% + $0.35 | Chat, FAQ | Zoolz, CanadaQBank |

Earlier, we’ve emphasized how important it is to choose a monetization model correctly. You may combine several approaches to increase your revenue, but the most likely, you include one of two tried-and-tested monetization models we’ve mentioned several blocks above. Let’s find out how the monetization model impacts payment gateway choice:

The subscription is for repeatable usage. This model will serve your needs if you are ready to provide valuable content or grant paid access to advanced features.

|

What types of businesses use a subscription model? |

News websites Content platforms File storages Fitness and healthcare apps Video/ audio streaming apps |

| Which payment gateway would be the best here? |

Braintree (Dropbox, Pinterest) Adyen (Netflix, Spotify) Authorize.net (Magento, YesMagazine) 2checkout (Zoolz, CanadaQBank) |

In-app payment is another possible choice.

| What types of businesses use an in-app purchase model? |

eCommerce apps Photo-sharing apps Location-based delivery apps Uber-like on-demand apps Hospitality apps |

|

Which payment gateway would be the best here? |

PayPal (GooglePlay, Microsoft) Stripe (Shopify) Checkout.com (Gettyimages, Bloomingdale’s) Square (Grubhub, UberEats) |

Building an online marketplace, security and regulated relations between buyers and sellers is a must. Thus, escrow comes in handy.

|

What types of businesses use an in-app purchase model? |

Online marketplaces |

|

Which payment gateway would be the best here? |

Braintree (Poshmark) Paypal (eBay) Stripe (Wish) |

Choose a payment gateway that meets your business needs, covers your region, is affordable for your startup, and easy to deal with for your engineering team.

The choice may seem hard, but after comprehensive research and with the help of our article, you get closer to the best tool. Payment gateway comparison shows that:

Still, each particular case requires a specific approach. Thus, if you want your startup to survive and succeed in an intense startups competition, a piece of reliable advice is essential.