AI solutions

What we do

Services

Experts in

How we work

Great idea and resources to implement it – this is all you need to start your own business. And once a great idea is born, a terrible where-to-get-money headache starts. Eventually, most of the potential startup founders give up their dreams and go back to the 9-to-5 office routine.

Even if the initial budget allows launching a startup, financial risks are still high. As statistics show, 80% of startups survive their first year, and only a little more than 50% can make it to the fifth anniversary. The reasons vary, but nearly 1/3 of startups fail because they run out of cash.

However, none of these is your scenario.

Lack of budget shouldn’t stop you from launching your great marketplace startup. Financial issues shouldn’t take success away. To help you to deal with the potential financial obstacles, we have prepared this guide.

Here, you’ll find the answers to:

...and so much more.

Right here, you will find all you need to know to raise funds for online marketplace startups.

So, you’ve got a prominent idea (or maybe you’ve even taken some steps to implement it). How to raise funds for your marketplace startup? Here we describe 7 proven strategies.

At the very beginning, having an unclear concept only, the best way to start is to use your savings.

What is it? Bootstrapping is starting a business with your own savings only, without any external investments.

What is the key feature? You make your decisions independently. In case something goes wrong, you aren’t ought to pay debts.

How much money can you raise? You and your savings define the sum.

Which company started with bootstrapping? Craiglist

Pros: You are completely independent; the whole startup belongs to you.

Cons: Working alone may be hard. Lack of support, both technical and financial, may negatively affect your goals and attitudes. A budget may be tight, which makes you look for another way to raise funds for an online marketplace.

More than 77% of startups rely on personal savings as a source of initial financing. And this is what bootstrapping is about.

This is a method of self-funding, the simplest, the fastest way to start working on your product. You invest your own money in the startup. As it grows, you keep re-investing the operating revenue and develop your small business relying on personal resources only.

Although it may seem hard, that’s an excellent method in terms of time: you start whenever you are ready besides, as the statistics show, that works great for most modern businesses.

Marketplace startup funded by bootstrapping: Craiglist, Toddy

Craiglist, a vast online marketplace worth more than $3 billion now, started its path with the founder’s personal money. Craig Newmark launched the platform in 1995, upgraded it annually, and received external funding only ten years later, in 2004.

Toddy is a marketplace for parents and babysitters developed by our team, experienced in providing online marketplace development services. Initially, the startup founder used his own savings to built the marketplace. To reduce the cost and time of MVP development, we employed Ionic as the core technology and released a hybrid app for iOS and Android devices.

Take a look at this interview, where Toddy owner David shares his experience of founding and funding a marketplace startup on Australian market.

Personal debt as a subtype of bootstrapping

A bank loan is one of the most widely used options to fund a startup. Consider a local financial institution and find out if you can get a loan on an initial stage of your business development.

Another way to raise funds is P2P online services like Peerform or Upstart. Keep in mind that it may be risky to start with debt until you don’t prove your startup’s viability.

Losing a startup may be hard; losing both startup and borrowed money may be much harder.

If you have an idea with a high potential augmented with a presentation or a simple prototype, you can attract the first investors from your network.

What is it? This is a fundraising method where you present the idea to your friends, relatives, and local community and ask for financial support.

What is the key feature? This is the fastest and easiest method of fundraising.

How much money can you raise? $1,000 - $10,000 and more

Which company started with money from the network? Tractor Zoom

Pros: A fast and easy method, which also works as a dose of extra motivation for you to reach your goals.

Cons: Lack of documented agreements, which often result in colossal responsibility, possibly ruined relations, etc.

People you love will not invest in your product; they will invest in you. And that’s an excellent funding method while you have no product to show.

Asking for help from your family, friends, a teacher, or a mentor will help you on the initial stage. In the US, this is the second most common funding source. Investments attracted this way may be limited. However, it is a fast and simple step towards great achievements.

How to ask friends and family for marketplace startup funding?

“Sell your idea in simple terms with both logic and passion,” says Martin Zwilling, the Founder and CEO at Startup Professionals, the company that assists startup founders worldwide.

If you target local businesses, e.g., build an eCommerce marketplace for farmers or a delivery app that is in high demand during a global pandemic, you can engage the local community. Prepare a short presentation and share it between the potentially interested users. Employ social media or even start a target advertising campaign to attract the community’s attention.

This type of collaboration will provide you with two essential things: an initial budget and confidence that your marketplace is in demand.

Marketplace startup funded by money from the network: Tractor Zoom, a marketplace that connects farm equipment sellers and buyers, started initial funding with friends and family round.

Looking for a way to attract investments, and promote your boosting product, take a look at crowdfunding platforms.

What is it? This is a way to raise funds through a donation from individuals or communities on specific online platforms.

What is the key feature? Crowdfunding allows spreading awareness about your product and raising money from potentially interested users.

How much money can you raise? $10,000 - 30,000 and more

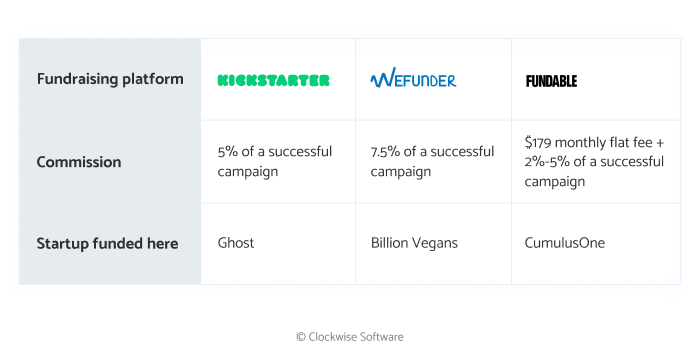

Which companies started with crowdfunding? Ghost, Billion Vegans, Cumulus One

For crowdfunding, you can pick one of the numerous available online crowdfunding platforms or combine several ones.

Typically, a crowdfunding website charges a commission. It may be either a subscription fee, a percentage from successful payments or total funds, etc.

Keep in mind that different platforms have different rules and policies. Most of them have a narrow focus and may fail to serve marketplace funding.

More thorough preparation and research are required to launch a campaign on a crowdfunding website. The idea isn’t enough anymore. You need to pick the community’s attention, prove that your product is excellent, and raise funds.

There are two major pitfalls with crowdfunding platforms you must be aware of at the very beginning:

Let’s take a quick look at the most popular crowdfunding websites:

Pros: a vast community. If you want your project to be viewed by as many users as possible, Kickstarter is the answer. Besides, Kickstarter has the highest success rate among similar platforms.

Cons: Kickstarter has geographical limitations. Only users from 18 countries can apply. The campaign submission process is tricky.

Commission: The service charges 5% of a successful campaign.

All or nothing. That’s the Kickstarter principle. It means that you either collect the exact sum of needed funds, or…get nothing. If the campaign fails by not reaching its goals, backers get their money back. The advantage is that the platform charges a commission only if the campaign is successful.

Here, you should demonstrate something exceptional to reach the goals. Potential investors expect to get something for their money. Offer a free trial, a subscription to your marketplace, discount codes, etc. to convince users to invest in you.

The platform works well for creative projects, fashion, arts, design, and technology. Still, it may serve well for marketplace startups funding.

Marketplace startup funded on Kickstarter: Ghost

This marketplace for bloggers and content writers collected nearly $300,000 on Kickstarter. Its founder, John O’Nolan, shared his experience, told about funds, expenses, pledges, and taxes.

“… the Kickstarter campaign and everything around it became an official success. We hadn’t just built one product and delivered it to our backers; we’d managed to create a sustainable open source business which would keep on going and last for years to come”, he says.

Pros: Impressive story and a massive community of more than 500,000 investors.

Cons: Rules and regulations are complicated. The service accepts companies from the US only.

Commission: 7.5% of a successful campaign.

How’s it’s different from Kickstarter? WeFunder allows investors to get a small, tiny stake of your company. At the same time, you can reach out to a huge community of supporters and raise the initial budget.

WeFunder has a remarkable story. Back in 2012, the founders faced some legal obstacles when they decided to create a crowdsourcing platform. They launched a petition in Congress, and several years later, regulations went live, which made it possible to invest as little as $100 in any startup.

Marketplace startup funded on WeFunder: Billion Vegans

Billion Vegans is the world’s largest online marketplace for vegan products. The startup raised more than $270,000 on WeFunder, and the sum keeps growing.

Pros: Fundable provides consulting services for startups.

Cons: The service charges a fee even if your campaign was unsuccessful. Also, it accepts only US-based campaigns.

Commission: $179 monthly flat fee + 2%-5% of a successful campaign.

If you have no idea what to start with, Fundable may come in handy. Its consulting services help startups develop everything from a clearer vision to design and marketing campaigns. However, it costs extra money. In terms of expenses, Fundable is a risky option: you have to pay fees no matter if your campaign is successful or not.

On Fundable, two types of campaigns are acceptable:

Marketplace startup funded here: CumulusOne

This platform that brings together travel media, travel services, and travelers themselves has raised $550,000 on Fundable.

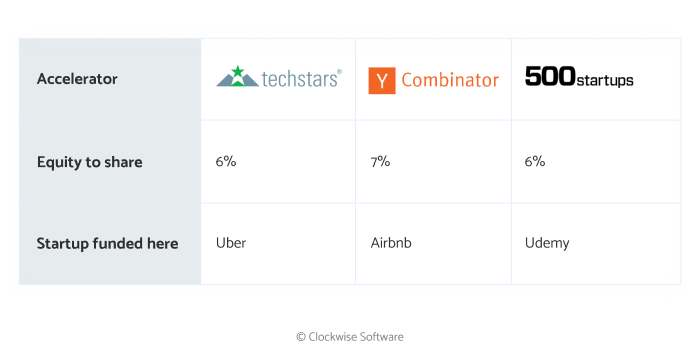

If your idea is something innovative, revolutionary or promising, you should take a chance to apply for a startup accelerating program

What is it? According to this method, a startup passes through a special accelerating program, meets investors, gets support and finances.

What is the key feature? The startup owner needs to share equity with a company-accelerator.

How much money can you raise? $100,000 - 150,000 and more

Which companies started with an acceleration program? Uber, Airbnb, Udemy

Pros: Support and reliability, opportunity to build a powerful network.

Cons: Intense competition. This is a time-consuming method that requires giving up a share of your marketplace startup.

30% of US startups pass through incubators programs.

Business incubators cooperate with investors, firms, educational institutions, and governments to support marketplace startups at their earliest stages.

Incubators and accelerators aren’t just a source of money. They also provide support with marketing and advertising tasks. With their help, you can build an entire network of potential investors and partners, promote your startup, and launch it successfully. Here, you can study how to develop, manage, and scale your startup from scratch.

Typically, a program duration is 1 to 3 months. It culminates with a presentation day. A day when you utilize all your skills, knowledge, and passion for highlighting your idea in the best way: you present your project to investors: if they like it, they provide you with funding for your startup growth.

Still, there’s a huge downside: the competition is cruel. For example, Techstars, one of the most famous startup accelerators, accepts less than 1% of startups’ applications. What about some other accelerators?

Founded in 2005, Y Combinator has helped over 2,000 great startups. It invests $150,000 in the company in exchange for a 7% market share. Annually, the company chooses 200+ startups to cooperate with.

The powerful organization that supports businesses from more than 75 countries worldwide. 500 Startups invests $150,000 for 6% of the startup share. The drawback is that to participate in its program, you need to pay a $37,500 participation fee.

Startups funded in business incubators: Uber, a P2P ride-sharing platform, started its path from a hard-to-get Techstars program. Airbnb, an accommodation booking marketplace, raised $20,000 on Y Combinator back in 2009. An online educational platform Udemy raised $3 million from 500 Startups.

Once you have an MVP or a simple initial version of your marketplace, you can also build a partnership with angel investors.

What is it? The cooperation with an angel investor means that an influential, famous person financially supports your startup in exchange for a business share.

What is the key feature? Finding an angel investor may be quite a challenge, but this person may provide you with valuable startup recommendations, introduce you to industry leaders, etc.

How much money can you raise? $50,000 - 100,000 and more

Which companies started with money from angel investors? Facebook

Pros: Investor’s support, new important business connections.

Cons: It’s hard to meet the right person. Losing equity may be painful.

An individual with a high net worth can become your business partner. Typically, an angel investor is a successful, famous person interested in investing their own money in a startup. In exchange, he or she gets a share of a company.

Forbes has entire lists of angel investors. Also, you can meet a potential investor on Linkedin, AngelList, or similar websites.

Vivino marketplace’s CEO, Heini Zachariassen, shares his experience of collaboration with an angel investor. At the early stages of marketplace development, he built cooperation with Janus Friis, one of the co-founders of Skype:_ “He knew us, and he was a passionate wine lover, so he funded our angel round.”_

Zachariassen recommends looking for an angel investor locally, paying particular attention to business owners who already succeed in the same industry.

_“Be careful they (angel investors) don’t try to grab too much of your company at this stage. You will need that equity later”, _he says.

Facebook once built cooperation with an angel investor, too. In summer 2004, Peter Thiel, a venture capitalist, made $500,000 angel investment in the greatest company of our time and got his share – 10.2%.

What is it? VC firm is a group of professional investors ready to support innovative powerful ideas.

What is the key feature? Cooperating with venture capitalists, you can raise a massive amount of investments. At the same time, they get a share of your future company and participate in decision-making.

How much money can you raise? $1,000,000 and more

Which companies started with VC funds? Alibaba, OLX, Etsy, Indeed

Pros: Chance to get more money.

Cons: You give a large piece of your equity. Also, VC firm's representatives influence decision making in the startup.

Venture capital firm is a group of individuals ready to bet on your marketplace startup growth. Venture capitalists professionally invest in startups and may provide you with support, consultancies, and valuable business tips in exchange for equity. Their profit depends on your company’s success.

Rates rise. You can get millions of dollars of investments. At the same time, you can lose a big part of your business, and investors can control and regulate your plans and movements.

It’s a challenge to make investors turn their heads towards your business as the competition is high. A great insight is having not just a business plan and a presentation but also a ready-made MVP showing your marketplace’s key functionality and potential.

Take a look at VC firms that focus on marketplace startups:

Focus: B2B and B2C marketplaces

Marketplace startups funded by FJ Labs: Alibaba, OLX

“Global marketplace investors.” This is how the company describes its key focus. FJ Labs supported more than 500 entrepreneurs globally. The investment process takes 1-2 weeks.

Focus: education products, financial services

Marketplace startup funded by USV: Etsy

The firm is one of the most powerful in the market: from 2011 to 2016, it had billions of dollars exits annually. Well-known companies like Indeed and Twilio were funded on USV, too.

What is it? This is a method of fundraising according to which you apply for a specific government program.

What is the key feature? You need to follow the defined rules to send your application.

How much money can you raise? It depends on a grant entirely.

Which companies started with money from the government? MyMoneyJar

Pros: Government grants are completely free to apply, and you don’t need to share equity;

Cons: a process is time-consuming and tedious.

Many countries support small businesses and are ready to invest in the online marketplace startup, especially those connected to ecology, healthcare, etc.

Thorough research is required to find the niche your government will be ready to invest in. Pay particular attention to underserved areas and target a specific location. Prepare your application according to government-defined requirements and be patient. It may take up to several months until your application will be reviewed.

Startup funded by the government: MyMoneyJar, a Dublin-based app startup for financial well-being, raised €700,000 thanks to the Irish government program.

There are seven common methods you can use to fund your marketplace startup:

Each one has its pros and cons. Each one has its specifics. However, as the real startups success stories show, each can serve you well in pursuing your key goal.

On your initial stage, decide what to start with. Build a to-do list. With a ready-made, simple and clear MVP, you have more chances to win the investors’ attention and prove your product is viable.

And there’s one more essential thing to keep in mind. Bill Gross, IdeaLab founder, in his TedTalk, says that timing is the most important factor of startup success.

Timing accounted for 42 percent of the difference between success and failure. Team and execution came in second, and the idea, the differentiability of the idea, the uniqueness of the idea, that actually came in third.

So waste not a second more, start working on your idea, meet a reliable partner for marketplace app development, and find out how much it costs to build a marketplace, raise funds, and launch your startup exactly when potential users need it most.