AI solutions

What we do

Services

Experts in

How we work

Every day, you can see headlines on TechCrunch, posts on LinkedIn, and hundreds of tweets boasting impressive amounts of investments. Startups announce six-figure-plus funding rounds, angel investors speak about super successful products, and it seems like fundraising has never been easier.

In 2021, startups worldwide raised a record $621 billion — over 100% more than in 2020. US venture funding hit a record of $311 billion, and while you read this article, another cool startup may be turning into a unicorn — in Q4 2021, there were 959 startups valued at more than $1 billion.

It seems like all you need to do is show your business idea to investors and they’ll start pouring money into your pockets.

But unfortunately, funding is much harder than that; less than 1% of startups get venture capital investments.

How can you get among those 1%? Along with a viable idea, a skilled team, an entrepreneurial mindset, and great ambitions, you may need a striking presentation to break into the list of leaders. And more than that, you need to know how to pitch an app idea to investors to win not only attention but investments.

This article will help you do that. Find out what you should start with and how to create and present an attention-winning pitch — and get four bonus tips to make your pitch brilliant.

How can you achieve your goals? Start with thorough preparation.

Let’s start with a significant question: Is your idea really worth pitching?

Probably, your answer is yes.

Thus, the next essential question:

Why do you think this particular idea is worth the investment?

To answer this question in detail, you should have initial documentation - as a project brief, a project roadmap, and a business model canvas - ready.

Translating your thoughts into a detailed vision on a laptop screen or on a sheet of paper is the first step towards a successful pitch. Brainstorm and define what you would like to build, how your app should look, and what basic functionality you would like to demonstrate. Behind every choice and answer there should be data that proves it’s reasonable.

How can you obtain this data? Start with quick market research and find out everything you can about the market you would like to enter, the A-players in this market, and users’ current needs.

Typically, startups collect this information during the project discovery phase.

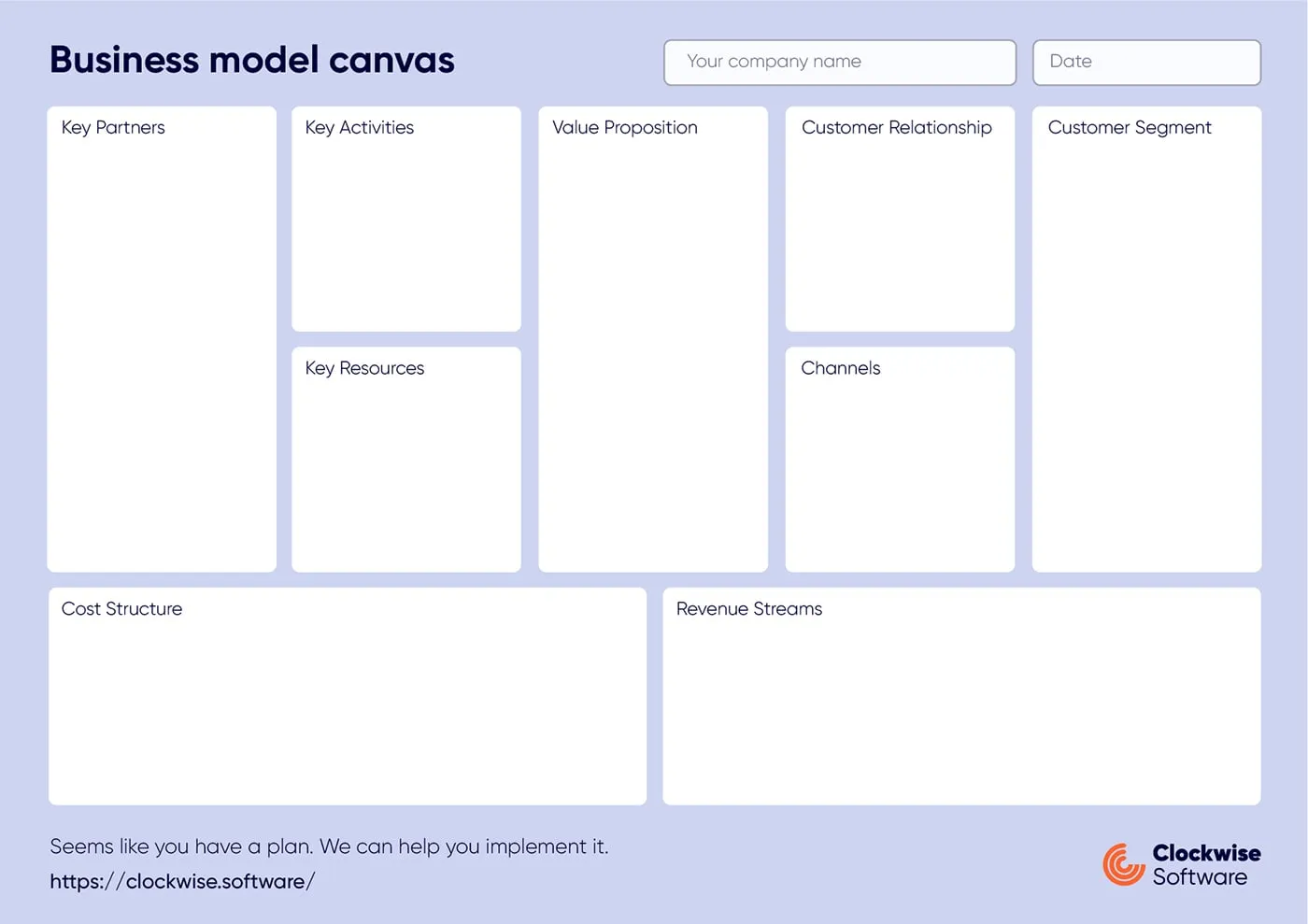

Next, convert your vision and market research data into a business model canvas.

This simple document is a must-have for every early-stage startup. In a business model canvas, you record information about your partners, activities, resources, value proposition, channels, customer segments, cost structure, and revenue streams. For help filling in all nine blocks, check our guide on how to create a business model canvas.

A landing page for startup, a simple app prototype or a minimum viable product (MVP) will be helpful at the initial startup development stages too. You can use these during beta testing to collect initial users’ feedback and discover ways to improve the idea you want to pitch to investors. With user feedback, you can clarify your vision, assess risks, and find hidden paths to success.

While rushing into meetings and trying to get in front of every investor in the world, founders tend to make a critical mistake: reaching out to the wrong people.

Before you pitch an app idea, know exactly to whom you want to pitch it.

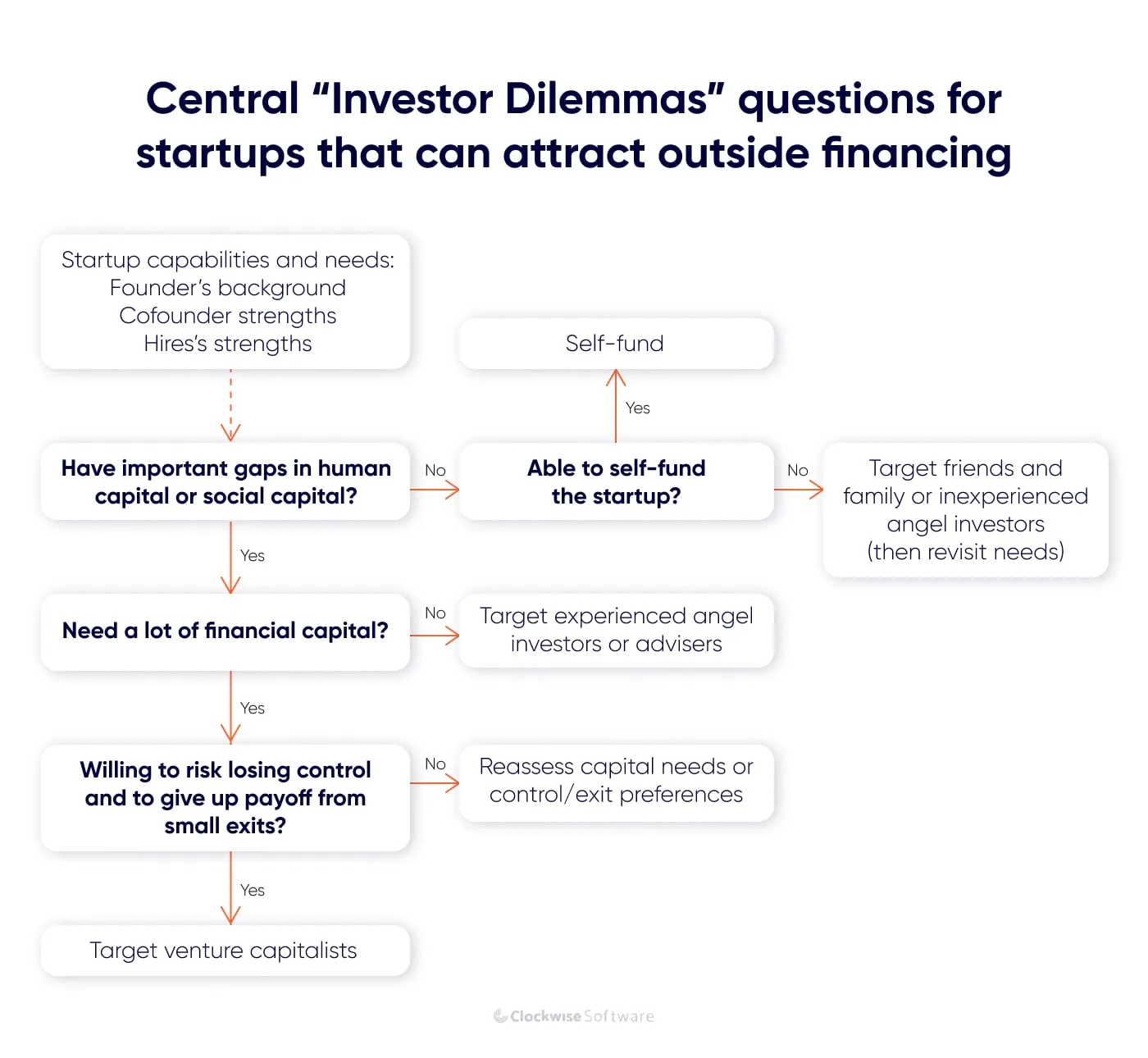

In The Founder’s Dilemmas, Noam Wassermann suggests a simple algorithm to decide whom you should reach out to.

Scan your market research results and your business model canvas one more time and analyze your and your co-founders’ backgrounds and skills to answer the questions below and identify your target investors.

There are several sources of funding. Here, we’ll review the three most popular:

The bootstrapping model leaves you and your co-founders on your own; but while you keep the equity in your company, you may lack external support.

When you cooperate with angel investors or VC firms, you don’t just pitch an idea and get money; you enter a long-term partnership.

“The best venture capitalists become trusted partners and advisors to the founders and team. They help recruit key employees. They introduce the company to potential customers. They help raise subsequent rounds of capital,” says William Sahlman, a professor at the Harvard Business School.

That’s why it’s essential to define who your potential partners should be at the very beginning. Besides, the more narrowly you target angel investors and capitalists, the more chances you get to build a fruitful cooperation.

To create a list of potential investors, focus on key factors:

SaaS founders don’t look for funding in the agricultural sector. And in the world of digital startups, different VC firms focus on different sectors as well.

For example, Rethink Education invests in education technology startups, General Catalyst invests in digital health companies, and JetBlue Technology Ventures focuses on travel and hospitality startups.

Know the niche you want to enter and shortlist angels or VC firms to tailor your pitch and get funds.

When you study profiles of angel investors on LinkedIn or investigate websites of venture capitalists, pay attention to their previous experience and take a look at startups they support. Determine types and sizes of companies they support, check when VC organizations were founded, and try to evaluate their experience in your field. Remember that you’re not just getting funds — you’re also meeting a partner. Not only will investors evaluate you and your product — you’ll also evaluate potential investors.

So make sure you reach out to promising and reliable potential partners who can not only financially support your company but also bring unique expertise, experience, and knowledge.

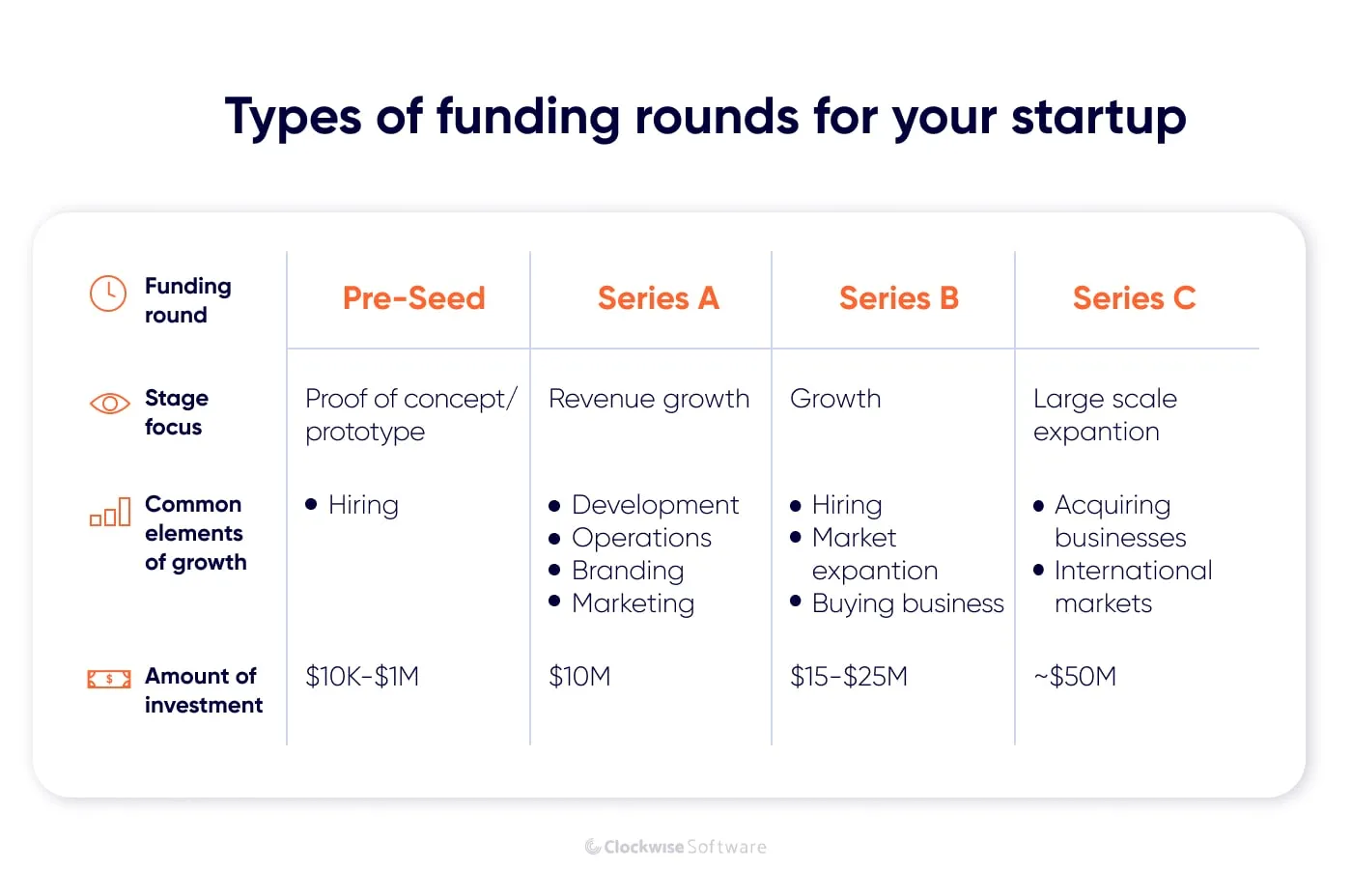

In the startup financing lifecycle, where’s your product?

Take a look at this table:

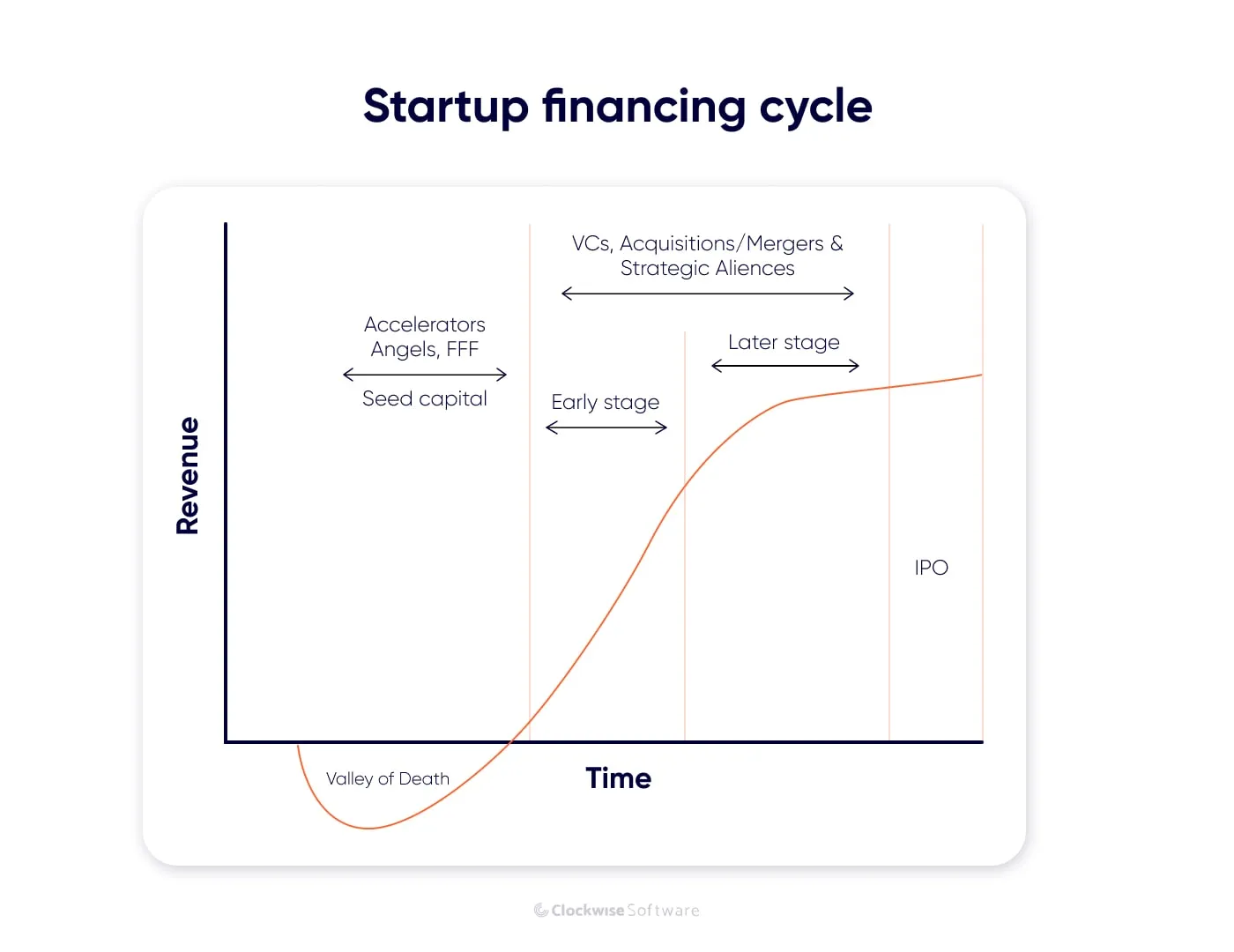

Now, let’s determine your position in the startup financing cycle and decide whom you should reach out to with your pitch.

If you’re at the seed stage, chances are your product is in the valley of death: it is live, but it doesn’t make any revenue. At this stage, founders can hardly get support from VC funds; they typically start with bootstrapping and then try to get funded by an angel investor. Participating in a startup accelerator — a program that includes mentorship, education, financial support, and introductions to investors — may still be the best option.

But if your early stage, Series A, Series B, or Series C startup already makes profit and you need a boost to extend your offering and strengthen your business, VCs are more likely to pay attention.

Still, some firms invest up to $500,000, while others can turn your product into a unicorn. Typically, VC firms invest up to $1 million in the seed round, which is much more than what you can attract from angel investors.

To select VC firms, map your resources and estimate the size of investment you need.

Estimate the amount of investment you need by answering a key question: Are you building a product from scratch or do you need money to improve an existing app?

If you have an up-and-running MVP and can prove traction, investors will show more interest in your app.

The first step towards a data-driven decision may be to estimate the rough cost to develop an app, promote it, and improve it. And while you may be tempted to ask for a million dollars right away, Paul Graham, a venture capitalist and computer scientist, recommends underestimating how much you need.

Saying initially that you’re raising $250k doesn’t limit you to raising that much. When you reach your initial target and you still have investor interest, you can just decide to raise more.

By setting lower expectations in the seed round, you increase your chances to address basic needs, attract investors’ attention, and even avoid failure.

What if you’re not in the seed round anymore? Your actions, budget, and needed funds depend on your particular case. For example, Buffer shares inspiring funding stories on its blog, so if you plan to launch an app similar to Buffer, we encourage you to dive into this startup’s story and find out more about marketing app development in one of our previous articles.

You know where you stand and you know whom you’d like to pitch an app idea to; you know the funds you’d like to raise and can’t wait to reach out to investors.

But can you just go to meetings empty-handed?

You need an unforgettable, attention-winning, million-dollar presentation to get to investors’ hearts and wallets.

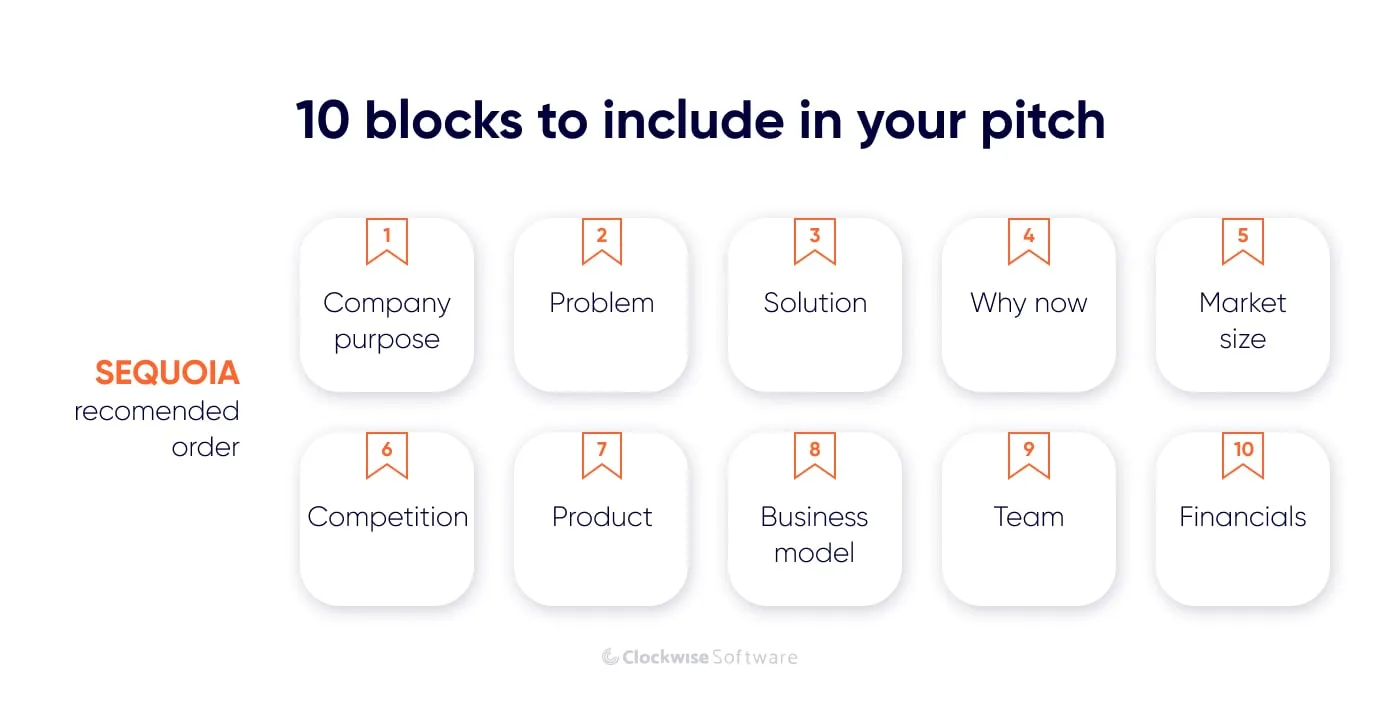

This presentation is called a pitch deck, and Sequoia Capital recommends including ten must-have blocks in your deck.

Formulate an answer to this question as a slogan: a clever yet laconic one- or two-sentence phrase that accurately describes your startup’s mission.

According to research by DocSend, the average pitch deck includes 19 slides, and a company’s purpose should be on the first two. Your task is to immediately capture investors’ attention and make investors want to find out more.

Follow author and TedX speaker Simon Sinek’s recommendations and start with why:

Here’s how Twitter’s founders describe the company’s mission:

“To give everyone the power to create and share ideas and information instantly, without barriers.”

Still, not all top startups have defined their purpose from day one, nor have all put the company’s mission in their pitch deck. For example, Netflix didn’t have any mission statement at first. Only in 2011 did Reed Hasting outline Netflix’s four main purposes.

Does the world really need heroes like you and your startup?

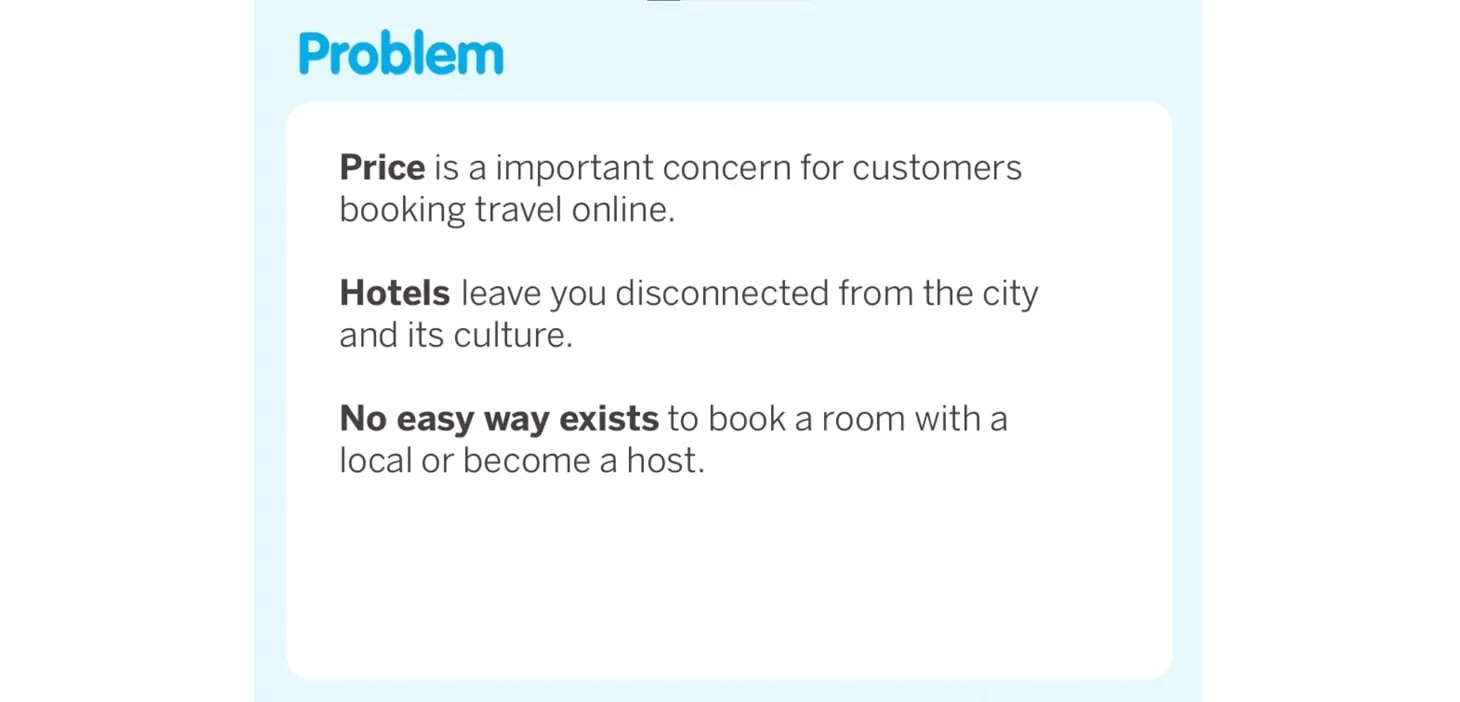

Put down informative answers. Make sure the problem you’re speaking about is real, topical, and monetizable. If you prove to investors that you can not only solve users’ problems but also monetize them, your chances to succeed may multiply.

Here’s how Airbnb described the problems the company aimed to solve:

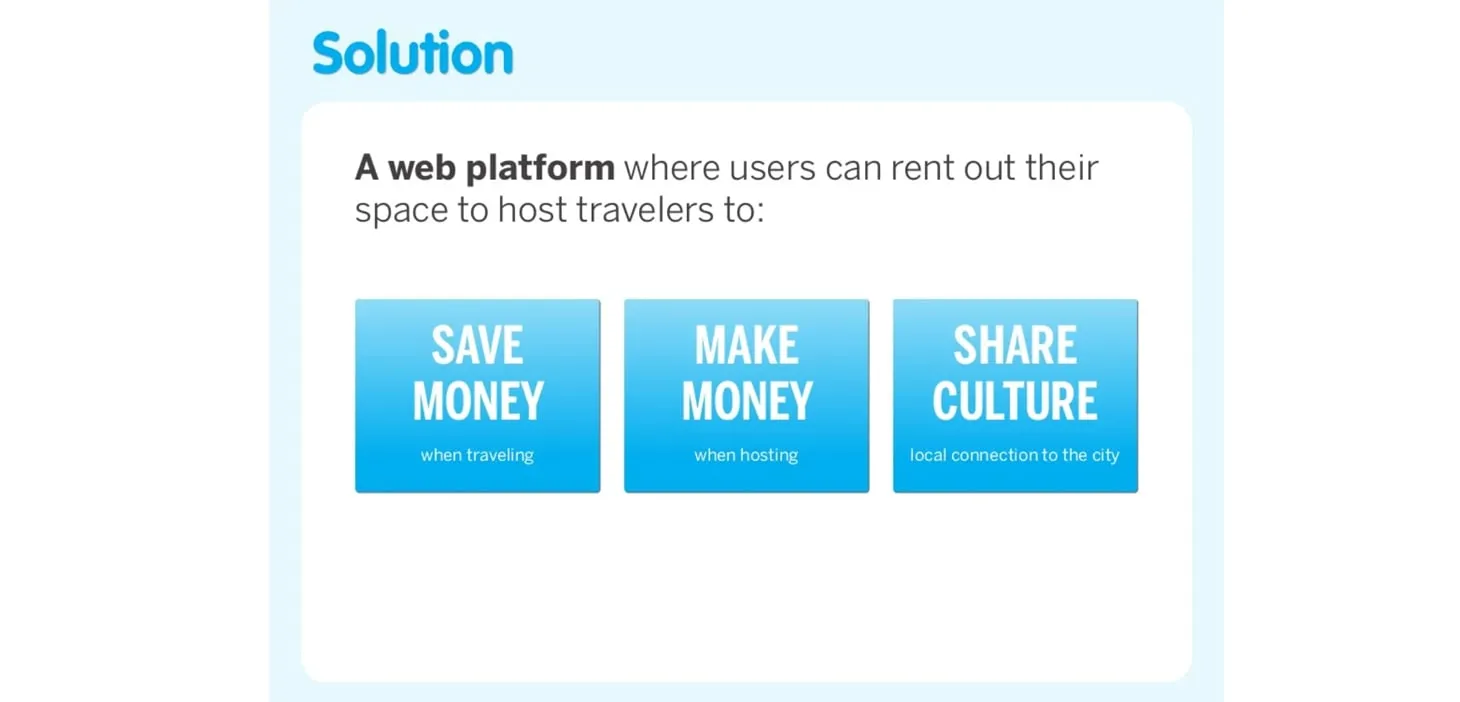

This should be a response to the problem you formulated in the previous section.

Here’s Airbnb’s solution:

To describe the proposed solution, you can organically mix your mission statement and the existing problem. Here, you can highlight your value proposition and impress listeners and readers with unique, exciting, or narrowly targeted functionality. To strengthen your position and keep interest, explain why existing solutions can’t solve this problem or why you think you can solve it better than others.

In his TedTalk, Bill Gross, a founder of the IdeaLab technology incubator, says that timing is the single biggest reason why startups succeed.

In the timing section, explain why you think the right time to work on and invest in your idea is now. Electric cars like Teslas are becoming popular because of environmental concerns and high fuel costs; digital health apps received record high investment in 2020 because of the COVID-19 pandemic.

Why do you think investors should support your product today, tomorrow, or in 2023?

This section also hints at your product’s potential and profitability. Consider your business development in the short-term and long-term perspective to explain why now is the best time for your startup.

Go back to the market research data you gathered when preparing to pitch an app idea. Describe market specifics, the market size, and market trends in this section of your pitch.

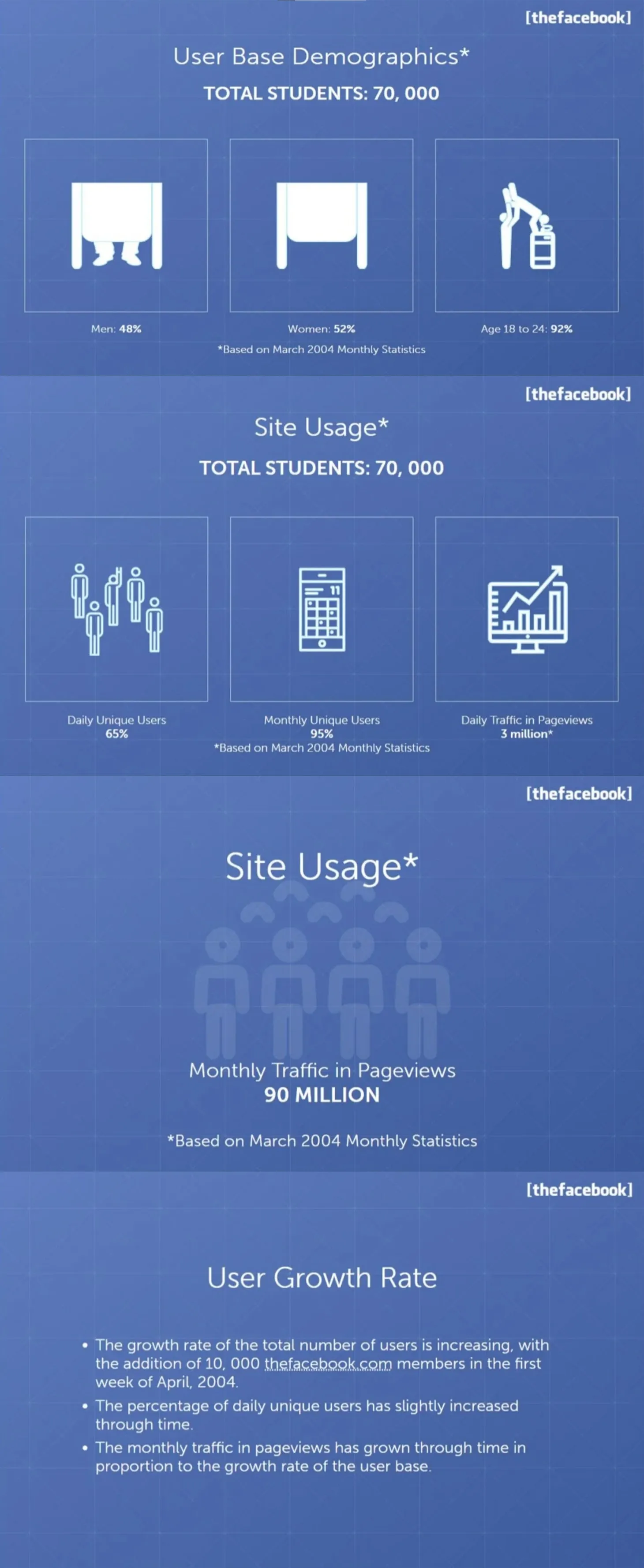

Strengthen your presentation and arguments with graphs and metrics from reputable sources like Gartner and Statista. Include information about your current user base and rough estimates of the number of non-customers you can attract with your product.

You can gain insights from Facebook’s pitch. The Facebook founders not only analyzed existing users back in 2004 but also built assumptions about the user growth rate. Seventeen years later, we can clearly see their assumptions were correct.

If you create an innovative product for a blue ocean of opportunities, there are no competitors you should analyze or learn from.

But when you enter a mature, dynamic market full of challenges and opportunities, you need to study your competitors and compare their offerings to yours

How can you compare your product to competitors’?

Be honest in your analysis and identify your weaknesses before anyone else starts questioning your product.

The product block should include a brief and clear overview of the app you’re working on. Share your product vision, explain where you are now, and make sure you answer these questions:

There’s no need to add the entire UI kit and clickable prototypes in this block. But if you can share wireframes or app screens to explain how it works, do so. Visual elements can speak louder than your entire presentation.

A flawed business model is one of the reasons why startups fail. And while you may hope to join the lucky four, your potential investors may need proof and real data to ensure you have a solid plan.

Earlier, you’ve worked on a business model canvas. Before you add it to your pitch, review it and pay particular attention to the cost structure and revenue streams sections.

How do you plan to make money with your app? Are you sure people are willing to pay for it?

If you don’t have definitive answers to these questions, don’t worry. A lean approach together with an Agile development methodology may help you test your assumptions and make better decisions in the future. But before you go to investors, it’s essential to have a draft of your answers.

“Your job as a founder is to quickly validate whether the model is correct by seeing if customers behave as your model predicts,” says Steve Blank, an entrepreneur and educator.

Your team members, relations between them, and dynamics inside your team are crucial for your startup’s success.

A VC firm will not only invest in your product; it will also invest in you and all members of your team, both current and future. So tell your potential investors who you work with. What is your team members’ expertise? What experience do team members have? What have they already done for this product?

Here, you can share your team’s achievements and specialists’ previous positions to increase credibility and take your pitch to a human level.

Consider engaging different specialists in your pitch preparation and presentation.

“Involving employees in pitching has another benefit: When they participate in generating ideas, they adopt a creative mindset that leaves them less prone to false negatives, making them better judges of their colleagues’ ideas,” says Adam Grant in his book Originals.

A cool pitch is far more than a way to get funds for your startup; it may also be a boost for your entire team’s improvement.

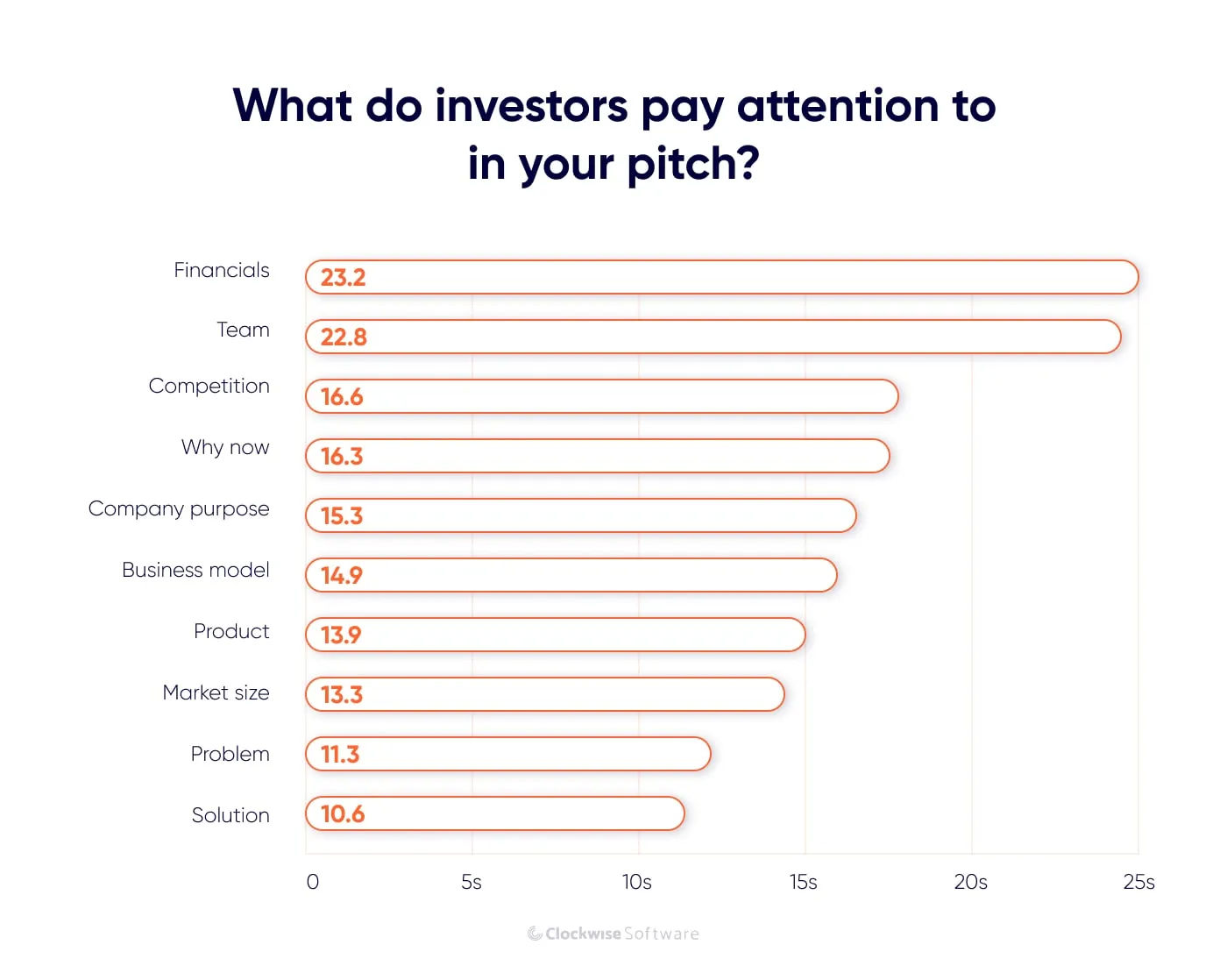

According to DocSend research, investors pay most of their attention to the financials — the last but definitely not the least important component of your pitch.

And financials may be the hardest block to fill in.

If you have traction, that’s great. Talk about it.

But if you’re an idea-stage or an early-stage startup founder, you may have made approximately zero dollars with your app, and you may have nothing to brag about.

Besides, it’s hard to predict how much profit you can make with your app in the near future.

This section is extremely important, and at the same time, you’re prone to making mistakes in it, as you probably rely solely on your hopes and ambitions.

Here’s a quick tip on how to prepare financial statements for your pitch:

How much will you make if your startup becomes successful? Can you provide a rough estimate of your potential success? Share your dreams in the optimistic section.

What if you don’t get investments anytime soon? What if your business plan for app startup won’t work? Describe the worst numbers you can imagine here.

What’s the golden mean? What is the most realistic case for your startup MVP development? Be honest with yourself and your potential supporters and estimate the most realistic numbers.

Connect these ten components together, use an attractive design template that matches your startup’s design concept, and wrap it in a nice presentation.

Alejandro Cremades, author of The Art of Startup Fundraising, also recommends including your contact details (including links to social media profiles) in your pitch so investors can quickly investigate your online appearance. If you have active social media profiles, use this tip and increase your chances to capture a VC’s attention.

Investors may request other documents from you, including these:

This is a short document that includes information about your product vision, team, traction, market specifics, and prior or expected funding. Your executive summary may be a shorter version of your pitch deck to use in emails or during short presentations.

These documents include financial, legal, people, sales, and marketing details of your startup. Depending on your funding round, you can use diligence checklists and ready-made templates to prepare them.

YCombinator recommends not spending too much time creating due diligence documents.

If an investor is asking for too much due diligence or financials, they are almost certainly someone to avoid.

Your brilliant pitch is ready, saved, and, just in case, copied to multiple clouds.

How to submit an app idea?

You can ask someone for an introduction, or you can contact investors directly on LinkedIn or via their website.

Introduce yourself, explain why you’re contacting the person or firm, and attach an executive summary to your email.

If there’s no response, don’t worry. Funding takes time.

The point is to initiate contact as fast as possible and follow up with target firms on a regular basis. For example, you can set bi-monthly notifications and send follow-up emails to shortlisted investors. In these emails, share your progress.

Here are some phrases you can use in follow-up messages:

Keep track of your progress and share it with potential investors.

Get ready to attend as many investor meetings as you can.

Unfortunately, even if your pitch is brilliant and looks just as promising as that of Bubble — a no-code startup that raised $100 million in series A — nobody is going to fund your startup the day you meet.

However, the more people you meet, the more you share your product idea and the more chances you get to attract not only investors and funds but also great team members to develop your product and media people to promote it.

These tips may be helpful:

Before every meeting, find out about as much as you can about the investor or the VC firm and its representatives. Study startups they invest in, and try to understand why they support these particular businesses.

We can talk forever about our children, pets, or startups.

But you have about 20 seconds to grab investors’ attention. If you fail to do this, you’ve probably lost the battle for your piece of the funding pie.

Once you’ve highlighted reasons _why _your product deserves attention and recognition, get ready to answer questions and convert your pitch into an interesting conversation.

If you’re not drowning in questions after your last slide, investors may simply be uninterested in what you’ve just presented. “Nine times out of ten, they’re not quiet because they’re politely listening — they’re quiet because they’re totally uninterested,” says Marc Rendolph in his book That Will Never Work.

Use this advice to improve your pitch:

You’re not the first founder who’s aimed to land a striking pitch. Learn how to do this right from successful startups. Check out the Sequoia blog, take a look at examples of pitch decks, subscribe to Startup Stories, and read inspiring articles on TechCrunch. These are sources with valuable insights on dos and don’ts for your pitch.

Storytelling is a great pitching tool. If you wrap your pitch around a captivating real-life story, you increase your chances to be remembered.

Yes, you’ve read that correctly.

Instead of pushing reasons to give you money, present a slide devoted to reasons not to invest in your product.

This takes advantage of the Sarick Effect. Put your product’s weaknesses and flaws right into investors’ hands, shed light on real risks you may face, and share key downsides of your app idea. As a result, investors won’t need to dig into your pitch trying to find errors; they’ll keep on listening to your presentation instead.

Although it may seem like absolute startup suicide, this is a tried and tested way to establish trustworthy communication and raise funds for a startup. In 2009, Griscom used this tactic to pitch Bubble. His experiment resulted in a $3.3 million deal.

In Silicon Valley, no one ever really tells you no. After a pitch, you’ll typically hear a sentence that begins with ‘This is great, but…'

— That Will Never Work.

Before you leave an unsuccessful meeting, listen carefully to what VC representatives tell you. Every recommendation, every tiny detail that follows after but may help you make the next meeting, the next pitch, and the next move in your startup development more successful.

No is an informative answer. Find a use for every rejection and turn it into a million-dollar deal.

Good preparation, confidence, and passion will help you create a powerful pitch deck and make your presentation attractive, potentially profitable, and interesting for investors.

As you present an app idea to the first investor, you open the door to a world of business relations, startup sponsorships, and fruitful partnerships. Get ready to close great deals, define your next steps, and build a product that soon will be listed on the pages of Hackernoon next to an impressive figure.