Payment gateway integration services

Fortune #40 Global Health Leader

1886-founded | 131K employees | $16B in R&D

NYSE: EB

850k creators | 300M tickets sold in 2023

8th GPS App in the US

3M+ in 2023 | 10M+ Google Play downloads

Cultural Exchange Led by 2K+ Team

Est. 1980 | 500K+ Alumni | 100+ Countries

$12M Revenue Tech Co.

MBE Certified by NMSDC

Trusted Logistics Co. Since 1979

ISO9001 Certified Systems Integrator

3rd in Retail Inc. 5000

$6M+ raised | #1 ranked company in CT

UCSF-Trusted Health App

with 50K+ users in 60+ countries

Google-Funded Green Tech

144K Ha Monitored | Featured by Reuters

Telecom Experts Est. 2005

Google, Proximus & Orange partners

NASA-Trusted Workflows Builder

Est. in 2007 | PCI, GDPR & HIPAA certified

Top Swiss Agency

Awarded #1 Swiss App in 2025

#2 SMM Agency in Australia

Serves 1k+ Australian B2B across 20+ domains

Google Cloud Partner

Trusted by Fortune 5 UHG

F&B Startup with 25K+ Guests/Y

4.5 on TripAdvisor | 600+ Dining Partners

Fortune #40 Global Health Leader

1886-founded | 131K employees | $16B in R&D

NYSE: EB

850k creators | 300M tickets sold in 2023

8th GPS App in the US

3M+ in 2023 | 10M+ Google Play downloads

Cultural Exchange Led by 2K+ Team

Est. 1980 | 500K+ Alumni | 100+ Countries

$12M Revenue Tech Co.

MBE Certified by NMSDC

Trusted Logistics Co. Since 1979

ISO9001 Certified Systems Integrator

F&B Startup with 25K+ Guests/Y

4.5 on TripAdvisor | 600+ Dining Partners

Google Cloud Partner

Trusted by Fortune 5 UHG

#2 SMM Agency in Australia

Serves 1k+ Australian B2B across 20+ domains

Top Swiss Agency

Awarded #1 Swiss App in 2025

NASA-Trusted Workflows Builder

Est. in 2007 | PCI, GDPR & HIPAA certified

Telecom Experts Est. 2005

Google, Proximus & Orange partners

Google-Funded Green Tech

144K Ha Monitored | Featured by Reuters

UCSF-Trusted Health App

with 50K+ users in 60+ countries

3rd in Retail Inc. 5000

$6M+ raised | #1 ranked company in CT

Trusted Logistics Co. Since 1979

ISO9001 Certified Systems Integrator

$12M Revenue Tech Co.

MBE Certified by NMSDC

Cultural Exchange Led by 2K+ Team

Est. 1980 | 500K+ Alumni | 100+ Countries

8th GPS App in the US

3M+ in 2023 | 10M+ Google Play downloads

NYSE: EB

850k creators | 300M tickets sold in 2023

Fortune #40 Global Health Leader

1886-founded | 131K employees | $16B in R&D

F&B Startup with 25K+ Guests/Y

4.5 on TripAdvisor | 600+ Dining Partners

Google Cloud Partner

Trusted by Fortune 5 UHG

#2 SMM Agency in Australia

Serves 1k+ Australian B2B across 20+ domains

Top Swiss Agency

Awarded #1 Swiss App in 2025

NASA-Trusted Workflows Builder

Est. in 2007 | PCI, GDPR & HIPAA certified

Telecom Experts Est. 2005

Google, Proximus & Orange partners

Payment integration services we offer

Integration with payment providers

Connect to Stripe, PayPal, Braintree, or any provider — start accepting payments fast and scale with ease.

Recurring billing setup

Enable subscription billing for your SaaS with retries, alerts, and dunning — reduce churn and keep revenue predictable.

Split & escrow payments

Automate fund splitting, escrow, and release flows — ideal for marketplaces, multi-vendor platforms, payout compliance.

Multi-currency & local payments

Accept payments globally with currency conversion, local methods like PIN Payments, and tax-ready data — no extra ops load.

Bank account data integration

Securely connect users’ bank accounts with providers like Plaid for fast account verification and ACH payments.

Custom payment flows

Tailor the logic: trials, hold periods, multi-step approvals, or in-app triggers — built around how your business works.

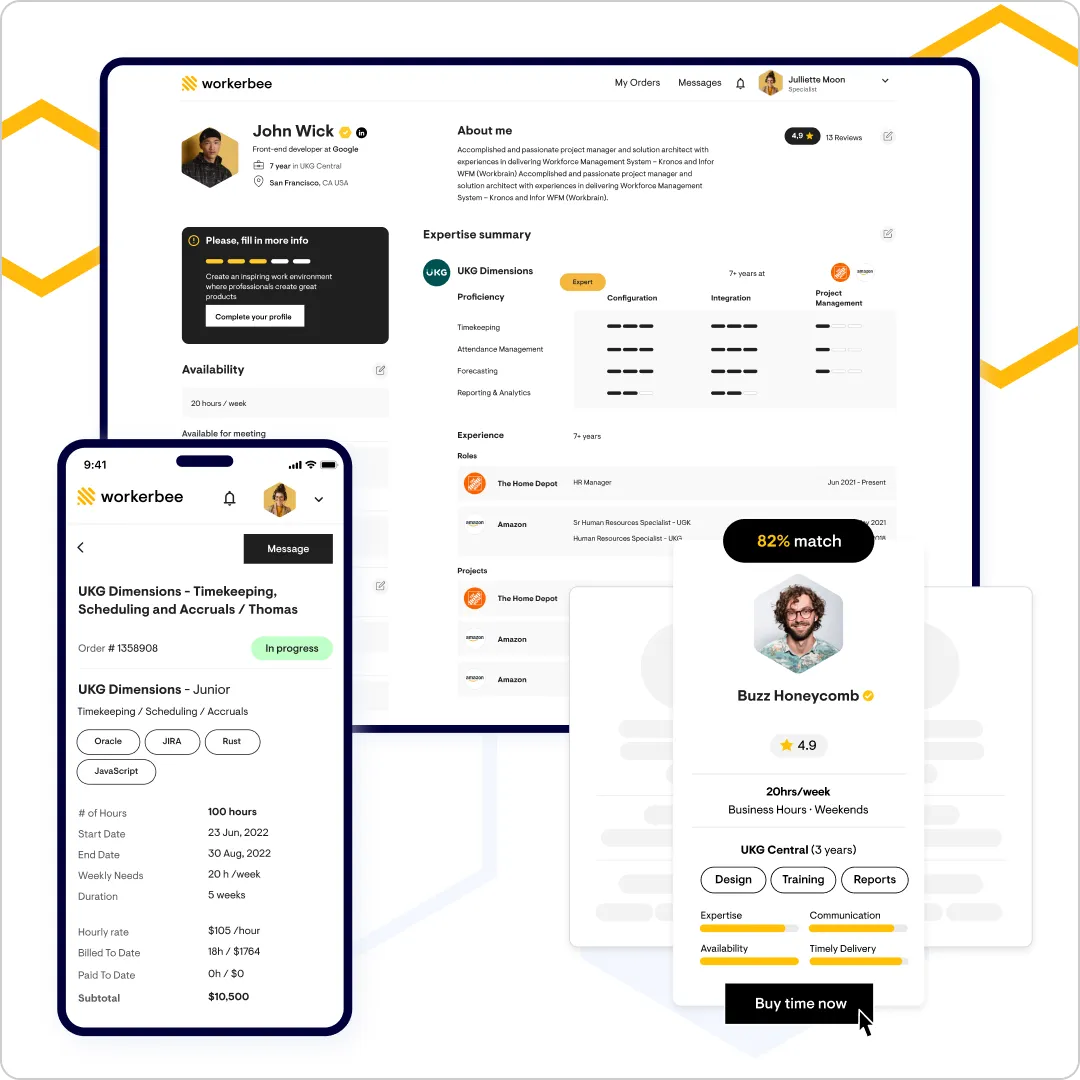

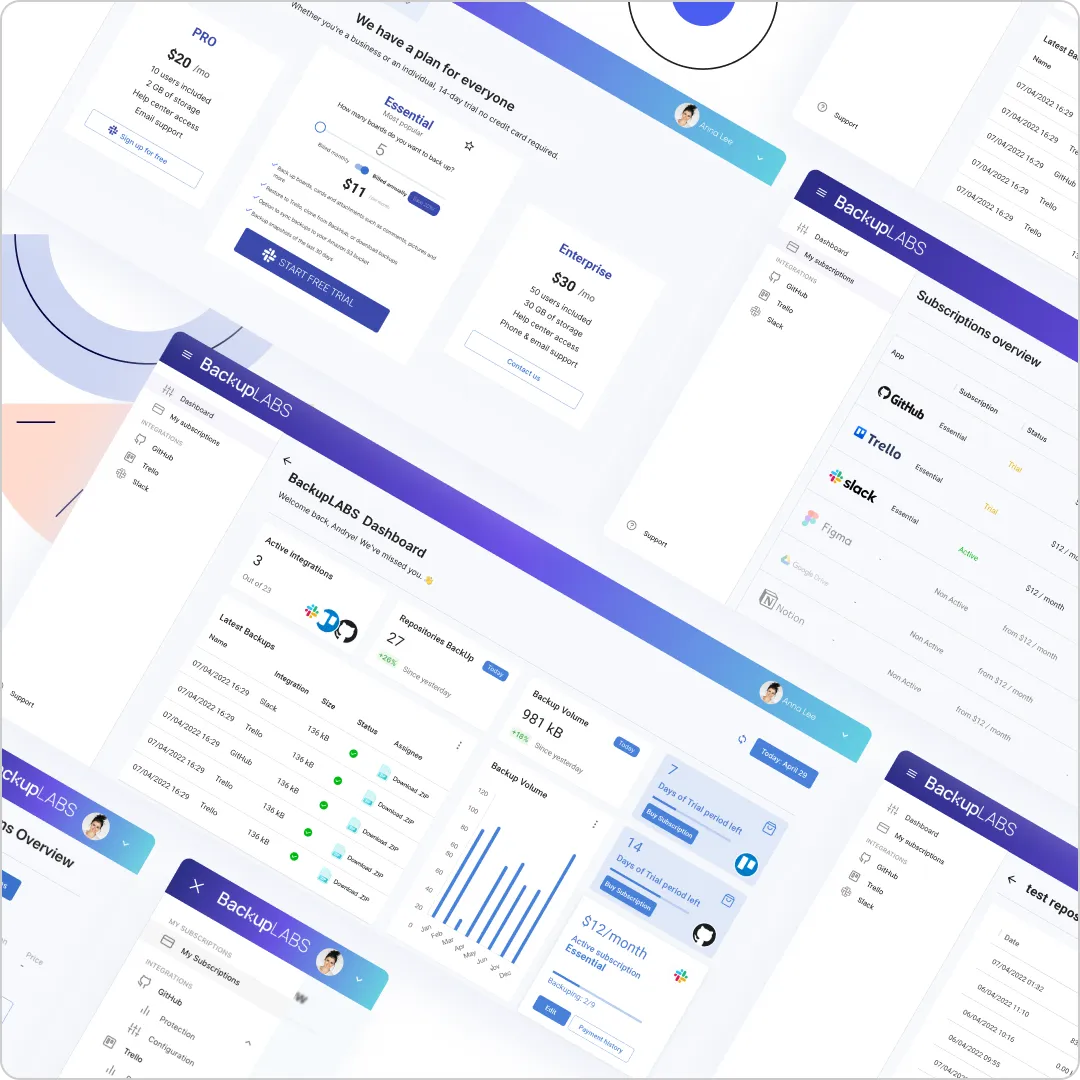

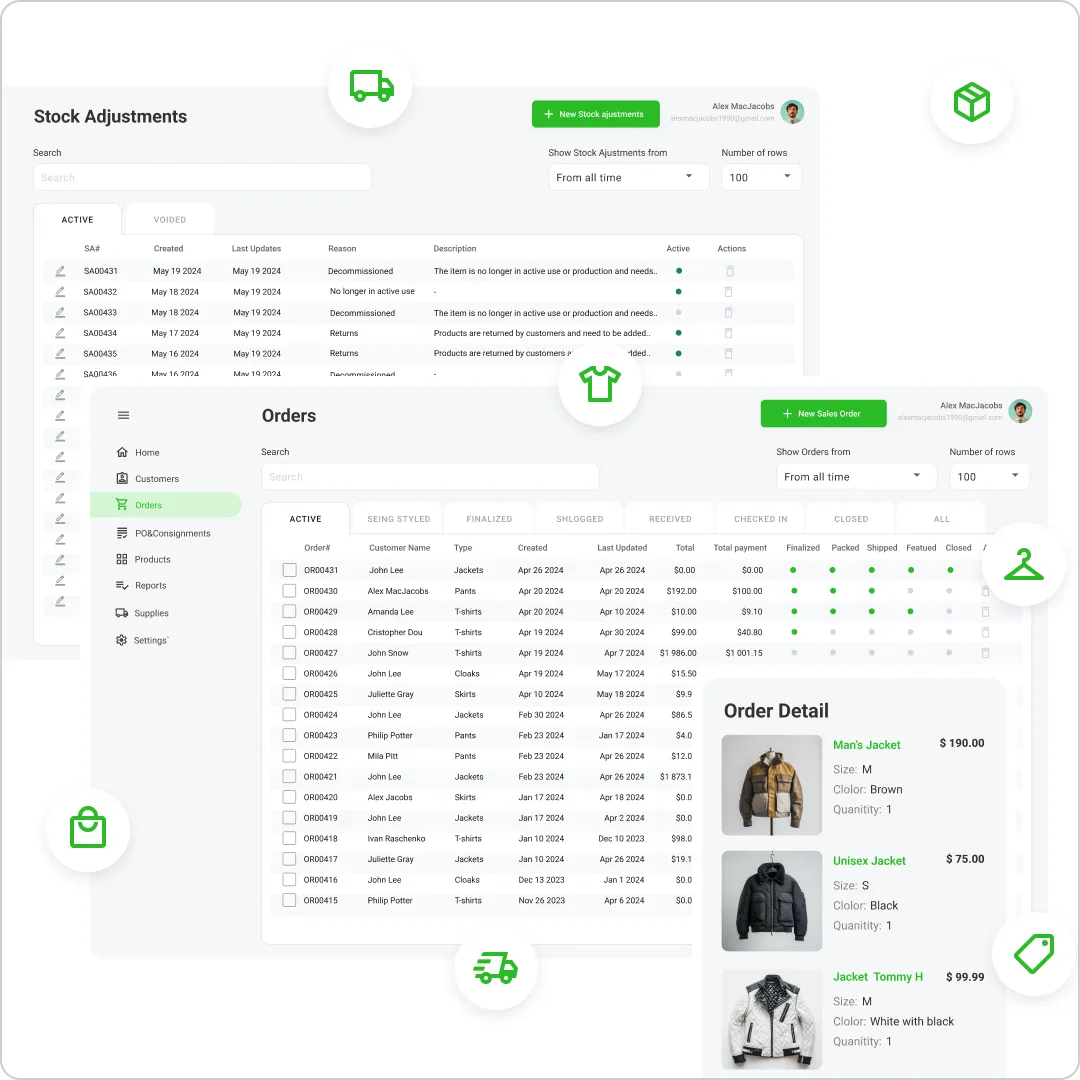

Our projects featuring payment gateway integration

Testimonials

Payment gateway integration process

Here’s how we do it:

1. Discovery & requirements analysis

We start payment gateway integration services by digging into your product goals and user types — whether you're running a subscription SaaS, a multi-vendor marketplace, or something in between. Together with your team, we map out the payment flows you need: one-time charges, recurring billing, split payments, local methods, or a mix of them all.

Our engineers explore your infrastructure and payment provider docs in depth — rate limits, authentication quirks, hidden edge cases — nothing slips through. We also assess commissions, jurisdictional nuances, and any compliance specifics upfront to build a payment setup that’s smooth, scalable, and tailored to your reality.

2. Provider selection & integration strategy

We help you choose the right payment provider — or a mix of them — based on your geography, currencies, transaction volume, and risk profile. Stripe, PayPal, Adyen, local banks? We dig into the details: API maturity, fee structures, onboarding flows, KYC requirements, and scalability.

Once that’s locked in, we design a backend architecture that can handle high volumes without breaking a sweat. We bake in security from the start — secure authentication (OAuth, API keys, JWT), encrypted transmission (TLS 1.2+), rate-limiting, and full compliance with your industry’s standards. We’ve know how to keep payment system integration secure.

3. Implementation process

This is where your payment flow comes to life. We integrate your chosen provider, configure gateway settings, and implement server-side logic for secure processing along with frontend components for a smooth user experience. Our team handles API communication, webhook management, and secure tokenization or sensitive data storage when needed.

We design flows that are flexible enough to support future features like recurring payments, vendor payouts, or multi-currency — without a full rework. Our team can even integrate hybrid payments, combining real money with bonuses or internal currency.

4. Testing for flawless implementation

Online payment gateway integration is where bugs get expensive, so we don’t leave anything to chance. We simulate real transactions, failed attempts, refunds, and edge cases across different devices, user regions, and usage patterns. Beyond the gateway itself, we test how payment behavior ties into your product’s ecosystem — from invoicing and order logic to analytics and reporting. Our goal is to catch potential issues before your users ever see them, keeping your integration fast, stable, and reliable under real-world conditions.

5. Deployment & monitoring

We roll out the integration with minimal disruption to your operations, keeping system stability front and center. Before going live, we run compatibility checks to make sure everything works smoothly with your backend, frontend, and third-party services. Once deployed, we monitor the first live transactions, validate webhook events in real time, and double-check that your internal systems — from order logic to reporting — are correctly reflecting payment statuses. If anything’s off, we’re on it fast.

6. Post-launch support & ongoing partnership

New business model? Entering new markets? Switching providers? We’re here for all of it. After launch, we stick around to support changes, from adding new payment flows and gateways to handling tax compliance updates or scaling for higher volumes. As your product evolves, we keep your integration efficient, secure, and easy to adapt, so payments never become a bottleneck.

Payment gateway integration, done right

Nothing is left unclear

Delivered with precision

Risks are handled early

No budget drift

We’re transparent about what we’re building, how it’s going, and what decisions need your input. You’ll get regular updates in plain language — not just Jira tickets or code commits. If something changes, you’ll hear about it early. If we need your call, we’ll ask directly. It’s a partnership, not a mystery.

What sets us apart?

- Integrated clients' platforms with Stripe, PayPal, and local payment gateways.

- PCI-DSS-aware integrations with compliant payment vendors only.

- Skilled developers, PMI standards, and refined QA ensure excellence.

- Continuous monitoring of CPI & SPI, actively managing scope to stay on track.

- Tailored communication plans and regular updates keep clear communication.

- Detailed reports, full access to code and documents ensure zero surprises.

150+

API integrations

10+

payment providers

99.89%

acceptance rate

2014

build products since

3.8 years

average tenure

5.5%

churn rate (2023)

Clearing up your concerns

Which payment providers do you usually work with?

Stripe and PayPal are the most popular picks — we’ve connected them to all kinds of products: SaaS platforms, marketplaces, mobile apps. But we’re not limited to just these. If you need another provider that fits your business model, location, or compliance needs, we can handle that too.

Can you integrate multiple payment gateways at once?

Yes, we’ve done this before. For example, on the EmailMeForm project, we built modular integrations for both PayPal and Braintree without disrupting the existing codebase. We apply the same approach to any payment gateway integration service project: flexible architecture that allows you to support multiple gateways without adding technical debt.

How do you ensure secure payment processing in our product?

We follow industry best practices to keep your transactions secure. Our team integrates your product with trusted payment providers like Stripe, PayPal, or Braintree — they handle PCI compliance and data protection.

On our side, we ensure safe communication through HTTPS and TLS, apply tokenization to protect sensitive data, and build modular, auditable payment flows that simplify security checks. We also thoroughly test payment scenarios, covering error handling and fraud prevention, so your users get a secure and reliable payment experience.

Can you meet our quality standards?

Yes, and we prove it in practice. Our work has a 99.89% acceptance rate across projects. For payment integration services, we define quality benchmarks with you at the start and make sure they are fully met through functional, load, and security testing, along with strict compliance checks. Throughout the process, you’ll get clear, regular updates on progress and results.

How do we stay in control during the integration?

You’ll have full visibility throughout the integration process. We share regular updates, detailed reports, and give you access to the codebase. Our workflow is built around transparency: sprint demos, clear documentation, and direct communication with the team. If you need answers or adjustments, you’ll always be able to reach the right people quickly.

How will we get expertise over outsourced parts?

We make sure your team fully understands how the integration works. We document the integration logic, API structure, workflows, and dependencies in detail. If needed, we also run knowledge transfer sessions and provide training. You get full access to the code and documentation, so your team can easily take over and evolve the system when needed.

How can we be sure you’ll deliver exactly what’s promised?

We commit to clear agreements and deliver on them — backed by a 99.89% acceptance rate. Throughout the project, we track progress against agreed goals and monitor CPI/SPI to keep delivery on time and within budget. You’ll get regular, detailed updates, so you can see exactly how things are moving forward.

Will the same team stay on the project to maintain continuity?

Yes — our average team member stays with us for 3.8 years, so we can keep the same specialists on your project for as long as needed. If changes do happen, we manage transitions carefully: with structured onboarding, detailed documentation, and proper knowledge transfer, while your project keeps moving without disruption.

How will we fully understand the outsourced code for internal maintenance?

We make sure your team can confidently maintain the system. You’ll get clear documentation, well-commented code, and a structured handover process. We also run knowledge-sharing sessions and training when needed, so your team is ready to handle future updates and troubleshoot without relying on us.

Will language barriers affect communication?

No. Our team works in English daily — 98% of our clients are from the US and UK and report smooth communication, both on project updates and technical details. You can expect clear, consistent conversations throughout the payment gateway integration process.

Will we maintain full IP ownership of the product?

Yes — all intellectual property created during the project is yours. We provide full documentation and hand over the entire codebase once the work is done, so you have complete control over the product and everything built for it.

How do you handle continuity and stability, given the situation in Ukraine?

We’ve delivered stable, uninterrupted service throughout the war. Our team works from multiple locations in Ukraine and abroad, supported by a fully cloud-based setup. We have backup infrastructure to manage power or connectivity issues, and we plan proactively to keep projects running smoothly. You can count on us to adapt quickly and keep your online payment gateway integration moving forward.

How do you keep estimates accurate and our budget on track?

We rely on hands-on experience to make realistic estimates — this helps prevent delays and budget overruns. As the project moves forward, we monitor progress closely using CPI and SPI metrics. If any changes come up, we manage them through a structured process and keep you fully informed, so the work stays aligned with your scope, timeline, and budget.

Payment integrations for real businesses

Marketplaces & multi-vendor platforms

Handle split payments, escrow, and vendor payouts with compliance and transparency.

SaaS products

Enable subscription-based payments for your users and automate recurring billing for predictable revenue.

On-demand apps

Provide instant payments, tipping, and flexible payout options for users and service providers.

E-commerce payment gateway integration

Support fast checkout with multiple providers and local methods to maximize conversion and reduce cart abandonment.

Fintech tools

Link user bank accounts securely, verify identity, and automate ACH or open banking transactions.

Membership platforms

Support recurring payments for memberships or donations, with tax-compliant receipts and billing logs.

Key people

Awards